Carlo B. Valerio | Natalie Isabel P. Lim

Pursuant to Revenue Regulation (RR) No. 16-2023 which became effective on 11 January 2024, the Bureau of Internal Revenue (BIR) has started requiring electronic marketplaces (e-marketplaces) and digital financial services providers (DFSP) to withhold a 1% income tax on ½ of their gross remittances to sellers or merchants for goods and services sold through their platforms.

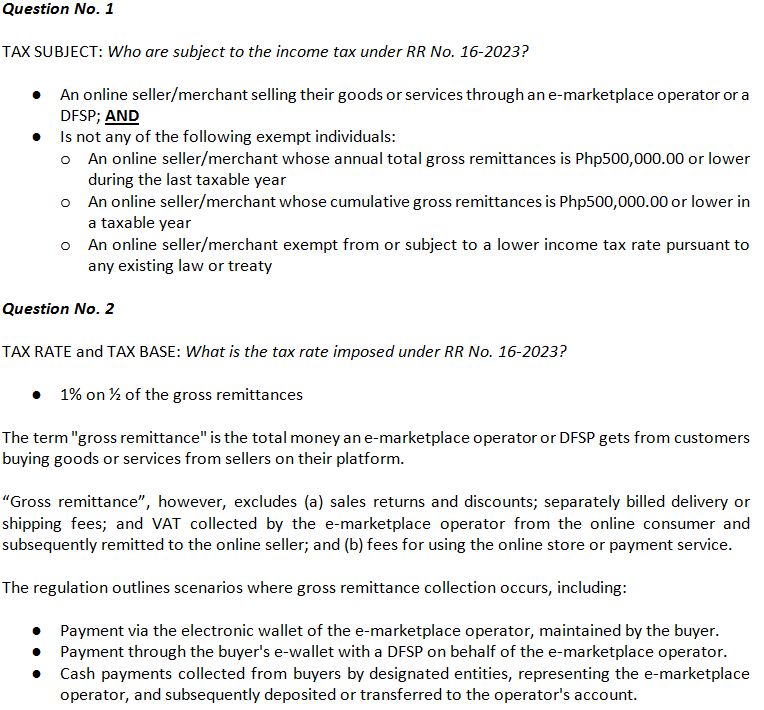

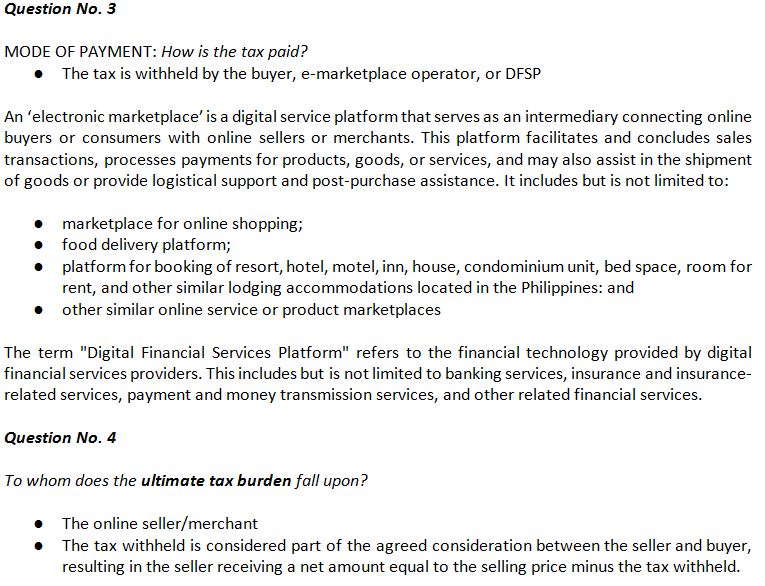

Here is a quick summary of RR No. 16-2023:

To guide the public and to clarify the timeline and implementation procedures of RR No. 16-2023, BIR has issued Revenue Memorandum Circular No. 8-2024 dated 15 January 2024.